How Much Money Do You Need To Retire At 58?

In the world of early retirees, we take a concept that goes by names like "The 4% rule", or "The 4% Safe Withdrawal Rate", or simply "The SWR."

As with all things financial, it'south the bailiwick of plenty of controversy, and we'll get to that (and and then punch it apartment) later. But for now, for those new to the concept, allow's define the Prophylactic Withdrawal Rate:

That sounds nice and simple, but many people consider it an unpredictable thing to nail down.

After all, yous don't know what sort of rollercoaster rides the economy will take your retirement savings on, and you lot also don't know what rate of inflation volition persist through your lifetime. Will a box of eggs price $half-dozen.00 a dozen when yous're 65, or volition it be closer to $sixty? So how can nosotros possibly know how much money nosotros volition need to live on in retirement?

The answers you get to this question vary widely.

Financial beginners (about 95% of the population) tend to randomly only throw out a number betwixt five-100 million dollars.

Financial advisers who aren't Mustachians will tell y'all that it depends on your pre-retirement income, (with the implicit supposition that you are spending most of what you earn) and the end answer will be somewhere betwixt two and 10 million.

Fiscal Independence enthusiasts will have the closest-to-correct answer: Take your annual spending , and multiply information technology by somewhere between xx and xxx. That's your retirement number.

If y'all use the number 25, you're implicitly using a four% Safe Withdrawal Rate, which is my own personal favorite number.

So where does this magic number come up from?

At the most basic level, y'all tin can retrieve of it like this: imagine you lot take your 'stash of retirement savings invested in stocks or other assets. They pay dividends and appreciate in price at a full rate of 7% per year, earlier aggrandizement. Aggrandizement eats 3% on average, leaving yous with four% to spend reliably, forever.

I can already hear a chorus of whines and rattling keyboards starting up, so let's qualify that statement. I admit it: that is the arcadian and simplified version.

In reality, stocks go upwardly and downwards every year, and so does inflation. Over a long multi-decade period like the gigantic retirement you lot and I volition be enjoying, enormous things have happened in the past. The Slap-up Depression. The Earth Wars, Vietnam, and the Cold War. The abandonment of the gold standard for US currency and years of 10%+ inflation and 20%+ interest rates. More recently, the cracking financial crash and a slicing in one-half of of existent manor and stock values.

If you lot happened to retire in 1921 on a generally-stock nest egg, you would have experienced an enormous stock run-up for the offset eight years of your retirement. You'd be and so rich by the time the 1929 crash and the Neat Depression hit, that you'd barely notice the trouble in the streets from your rosewood-paneled tea room.

On the other paw, if you lot retired in early on 2000 while property stocks, you saw an firsthand and huge drib in your savings forth with low dividend yields – and your 'stash may be accept had some scary times in the early days, and again effectually 2009. Would you withal take any money left today?

In other words – the sequencing of booms and crashes matters. Ideally, y'all want to achieve your magic retirement number in a time of nice, reasonable stock prices, just before the first of some other long nail so that your retirement starts off on a good foot. But you can't predict these things in advance. And then once more, how do we discover the correct answer?

Luckily, various Early on Retirement Ninjas have washed the piece of work for usa. They analyzed what would take happened for a hypothetical person who spent thirty years in retirement between the years 1925-1955. then 1926-1956, 1927-1957, and so on.

They gave this imaginary retiree a mixture of l% stocks and 50% 5-year US government bonds, a fairly sensible nugget allotment. Then they forced the retiree to spend an ever-increasing corporeality of his portfolio each year, starting with an initial percentage, then indexed automatically to inflation every bit defined by the Consumer Price Index (CPI).

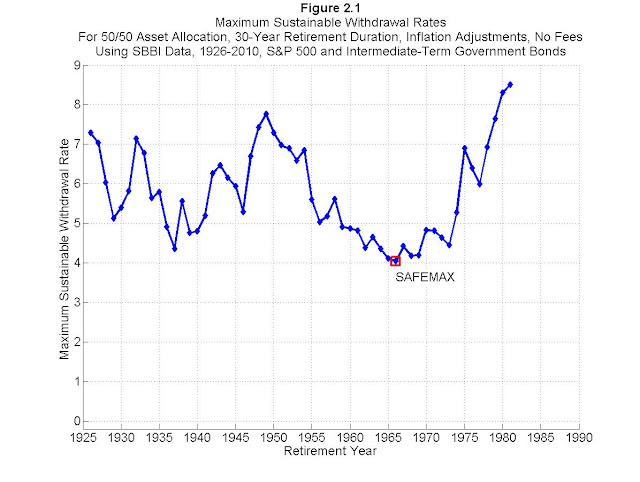

This uncomplicated but important serial of calculations was called the Trinity Study, and since then it has been updated, tweaked, and reported on, and it's still the subject of lots of debate today. Wade Pfau is one reasonable voice in the industry, and he created the following useful chart showing what the maximum prophylactic withdrawal rate would have been for various retirement years:

As you tin see, the 4% value is actually somewhat of a worst-case scenario in the 65 yr period covered in the report. In many years, retirees could have spent 5% or more of their savings each year, and even so ended up with a growing surplus.

This brings me to a disquisitional point: this study defines "success" equally not going broke during a 30-year exam period. To people like you and me who volition enjoy 60-year retirements, that would non be successful – nosotros want our money to concluding much longer than 30 years.

Luckily, the math in this example is pretty interesting: at that place is very lilliputian difference betwixt a xxx-year flow, and an space year menses, when determining how long your money will last. It's much like a 30-year mortgage, where almost all of your payment is involvement. Drib your payment by just $199 per month, and suddenly you lot've got a thousand-year mortgage that will literally take you k years to pay off. Increase the payment by a few hundred, and you lot have a fifteen year payoff!

In other words, above xxx years, the length of your retirement barely affects the safety withdrawal rate calculations.

Then far, we're liking the four% rule quite a bit, right? Simply yet whenever I mention it, I become complaints. Let'southward review a few of them:

- The trinity study is based on a prosperity bibelot: the U.s.a. during its blast years. You can't project good times like that into the futurity, considering we're just nigh to enter the Doom Years!

- Economic growth and stock appreciation was all based on cheap fossil fuels. How will this all look later on Summit Oil hits us!?

- You can't take a one-size-fits-all rule and apply information technology to something as varied as an economy and an private'southward life! My health care costs could go up! Hyperinflation could strike!

- Even at a 4% withdrawal rate, in that location's still a run a risk of portfolio failure. That means I'll be flat bankrupt and out on the street in my one-time age. I recommend doubling your savings, and going for a 2% SWR instead considering in that location's never been a failure in that scenario!

- This is all wrong! Waaah, waaah!

That's all well and proficient. While at that place are solid economic analyses that I believe can out-debate the points higher up, I'm non patient or clever enough to copy them here. Pessimists are costless to enjoy their pessimism and even write about it on their own blogs.

Instead of debating unprovable points similar those above, we can completely squash them with our own much more than powerful list of points:

The trinity report assumes a retiree volition:

- never earn any more money through part-time piece of work or self-employment projects

- never collect a single dollar from social security or any other pension plan

- never arrange spending to account for economic reality like a huge recession

- never substitute goods to compensate for inflation or price fluctuation (vacation in a closer place i yr during an oil price spike, or switch to almond milk in the effect of a dairy milk embargo).

- never collect whatever inheritance from the passing of parents or other family members

- and never do what most old people tend to practice according to studies – spend less every bit they age

In curt, they are assuming a bunch of drooling Complete Antimustachians. You and I are Mustachians, meaning we have far more flexibility in our lifestyles. In brusque, we have designed a Safety Margin into our lives that is wider than the average person'south entire retirement plan.

So at present that we're feeling skillful near the 4% rule over again, let'due south bring the indicate domicile:

Far from being a risky proposition, planning for 4% Safe Withdrawal rate is actually the most conservative method of retirement saving I could mayhap recommend.

To apply it in real life, but take your almanac spending level, and multiply it by 25. That'southward how much you need to retire, at the almost. A $25,000 spender similar me needs $625,000. I've got more than that, plus various prophylactic margins in the lifestyle, and so all is expert.

Without undue risk, and as long as you have skills that can be used to earn money somewhen in the hereafter (hint: you do), I tin can even abet an SWR of 5%. In other words, get your expenses downward to $25k, and yous can quit your job on $500k or less. Then you can use the methods described in Beginning Retire, so Become Rich to gradually increase your prophylactic margin (and finer decrease your withdrawal rate) as you age.

And then at that place'south no demand to debate. 4% is a perfectly good reply, which ways 25 times your almanac expenses is a perfectly adept goal to save for. Along the way, you lot might observe your almanac expenses melting away, which makes things always-more-attainable (as shown in the shockingly simple math behind early retirement mail). But worry, you must not.

And if yous're fix to play with the numbers even further, check out the FIREcalc website. It'south basically like owning your own Trinity Written report car, except you tin can tweak variables (expect at the tabs at the top of the page). In the link provided, I used this data:

- 500,000 portfolio

- 25,000 almanac spending (5% withdrawal rate).

All alone, a program like that over 60 years of retirement only has a 45% success rate, historically speaking.

But if y'all make adjustments which include:

- $eight,000 per twelvemonth of social security starting about 25 years from now

- "Bernicke's Reality Retirement programme" of dropping spending slightly with age

- Just $iii,000 per year in fooling-around income

Yous're already at an over 90% success charge per unit. Another hundred or 2 dollars per month and you lot have a 100% take chances of success, fifty-fifty without invoking many of my other bullet points above.

And then that, at last is the long-awaited Safe Withdrawal Rate article.

In the easily of fiscal infants, the rule is dangerous and scary. But in the hands of Mustachians, nothing is scary. Planning for a 4% withdrawal rate is a shiny, bulletproof limousine of a retirement plan and you can ride it all the way to the party at Mr. Money Mustache'due south house.

Source: https://www.mrmoneymustache.com/2012/05/29/how-much-do-i-need-for-retirement/

Posted by: songfoloot.blogspot.com

0 Response to "How Much Money Do You Need To Retire At 58?"

Post a Comment